How to create an expense approval workflow in quickbooks online

Table of Contents

In today’s fast-paced business world, a clear expense approval workflow is key. QuickBooks Online makes managing expenses easy. It helps businesses check all expenses before they’re approved. This guide will show you how to set up a smooth expense approval workflow in QuickBooks Online. It will help improve your financial control and oversight.

Key Takeaways

- Understanding the components of an expense approval workflow.

- The role of QuickBooks Online in managing expenses effectively.

- Benefits of establishing an organized expense management system.

- Steps to customize your expense approval settings in QuickBooks Online.

- Importance of setting approval limits to maintain financial control.

- Best practices for implementing a successful expense approval process.

Understanding Expense Approval Workflows

An expense approval workflow is key for any company looking to manage its money well. It’s a step-by-step process to check all expenses before they’re added to the accounting system.

What is an Expense Approval Workflow?

The expense approval workflow starts with submitting expense requests. Then, they’re reviewed and either approved or rejected based on set rules. Each company’s workflow is different, but its main goal is the same: to track and validate expenses carefully. This helps keep spending in check and promotes responsible spending.

Importance of an Expense Approval Workflow

Having an expense approval workflow is vital for keeping finances in order and following rules. It helps watch spending, lowers the chance of fraud, and makes sure expenses fit within budgets.

A clear workflow also makes it easier to keep a detailed audit trail. This is crucial for accurate financial reports and meeting legal standards. By focusing on expense approval, companies improve tracking and encourage employees to be accountable.

Benefits of Using QuickBooks Online for Expense Management

QuickBooks Online brings many benefits for managing expenses. It makes processes easier, helping businesses run smoothly. It also keeps a close eye on financial activities.

Streamlined Processes

QuickBooks Online makes managing expenses easier with automated workflows. Managers and employees can quickly submit and approve expenses. This cuts down on manual work and reduces errors.

Automation boosts productivity. Key features include:

- Automated expense submissions: Employees can easily submit expenses, reducing paperwork and approval delays.

- Quick approvals: Approvals happen fast, leading to quicker reimbursements and happier employees.

- Track spending in real time: QuickBooks Online lets you see expenses right away, helping stay within budget.

Improved Financial Oversight

Good financial management needs strong reporting tools. QuickBooks Online offers these tools, helping with budget monitoring and expense visibility. Important benefits include:

- In-depth reporting: Create custom reports to better understand expense trends and make smart decisions.

- Real-time access: Financial data is always available, allowing for quick spending adjustments.

- Visibility into spending patterns: Spot areas for cost savings or efficiency, leading to better financial strategies.

| Feature | Benefit |

|---|---|

| Automated submissions | Reduces manual errors and saves time |

| Quick approvals | Enhances employee satisfaction |

| In-depth reporting | Enables informed financial decisions |

| Real-time access | Facilitates timely budget adjustments |

Setting Up QuickBooks Online for Expense Approvals

Starting an expense approval workflow in QuickBooks Online needs a strong base. Focus on initial configuration to use the platform’s full potential. Good planning avoids future issues and makes approval smoother for your team.

Initial Configuration Steps

The setup begins with setting up account settings for expense tracking. Make sure all expense approval features are turned on. Also, set up access levels for team members to easily submit and review expenses. Clear roles help in a smooth approval process.

Customizing Your Settings

QuickBooks lets you customize a lot. You can make custom settings that fit your company’s needs, like specific expense categories. Setting rules for approvals, like limits and conditions, helps manage money better.

Integrating with Other Tools

Connecting with other financial tools boosts expense management. Linking with project apps or receipt software makes workflows smoother and cuts down on manual work. This lets teams focus on their main tasks while keeping expenses accurate.

| Configuration Step | Description | Benefits |

|---|---|---|

| Account Settings Activation | Activate expense tracking features in QuickBooks Online. | Enables automated expense submission and reviews. |

| Team Member Access Levels | Define roles for submitting and approving expenses. | Enhances accountability and workflow efficiency. |

| Customization of Expense Categories | Create categories relevant to organizational structure. | Improves categorization and financial reporting. |

| Third-Party Integration | Integrate other financial tools for enhanced functionality. | Streamlines processes and reduces manual entry errors. |

Creating Expense Categories in QuickBooks Online

Setting up expense categories is key for good budget management. QuickBooks Online lets you create these categories based on departmental needs or project types. This makes tracking expenses easier and helps with financial oversight.

Defining Your Categories

When you set up expense categories in QuickBooks Online, think about a few things:

- Departmental Needs: Make categories fit each department’s unique needs.

- Project Types: Create categories for specific projects for accurate tracking.

- Standardization: Keep categories consistent to make budget management easier.

Assigning Permissions and Roles

User permissions are vital for keeping the expense workflow right. In QuickBooks Online, admins can set up roles management well. This includes:

| Role | Permission to Submit Expenses | Permission to Approve Expenses | Accessible Expense Categories |

|---|---|---|---|

| Employee | Yes | No | Departmental categories only |

| Manager | Yes | Yes | All categories |

| Administrator | Yes | Yes | All categories |

This setup makes sure everyone is accountable and helps manage expenses well. It also makes sure the budget is taken care of in the organization.

How to Set Up Expense Approval Limits

Setting the right approval limits is key to good expense management. These limits show the max amount an employee can ask for without extra checks. Knowing how these limits work helps keep spending in check and protects the company’s money.

Understanding Approval Limits

Approval limits are like safety nets in the expense approval process. They set clear rules, making it easier to approve expenses quickly. This way, employees are more careful with company money, which helps everyone stay responsible.

Configuring Limits in QuickBooks Online

It’s easy to set up approval limits in QuickBooks settings. You can adjust them based on each employee’s job and the type of expenses. This makes managing expenses simpler and helps everyone work more efficiently.

| Role | Category | Approval Limit |

|---|---|---|

| Manager | Travel | $1,500 |

| Team Lead | Office Supplies | $500 |

| Employee | Meals | $200 |

| Senior Management | Conferences | $3,000 |

Implementing an Approval Process in QuickBooks Online

Setting up an approval process in QuickBooks Online is key for better expense management. It makes sure all expenses are checked against set rules. This helps businesses keep a tight grip on their finances.

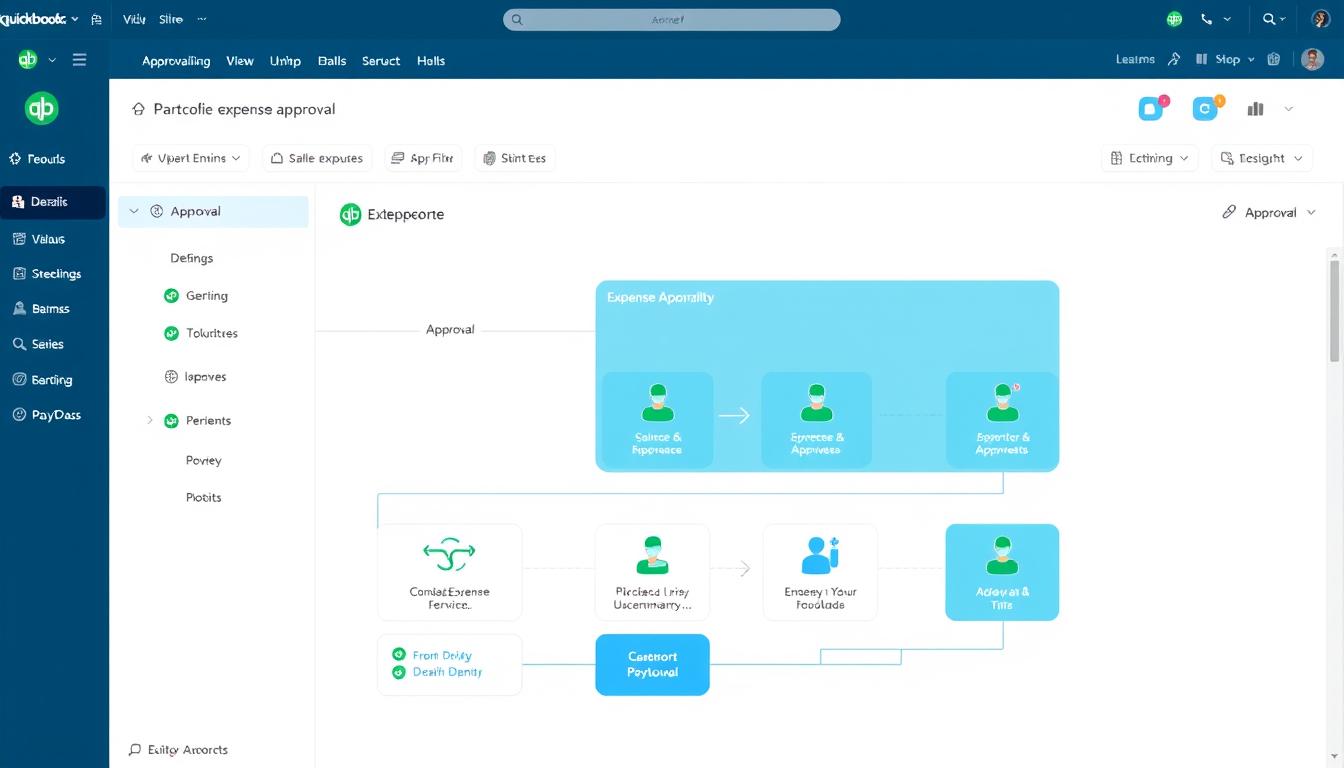

Crafting Your Approval Workflow

A good approval workflow starts with clear steps. You need to decide who submits expenses and who reviews them. QuickBooks customization helps make workflows fit your business perfectly. This avoids confusion during reviews.

It makes sure everyone knows their part in the process.

Steps for Submitting Expenses

The expense submission process in QuickBooks Online is easy to use. Employees should follow these steps:

- Log in to QuickBooks Online and find the right section for expense submission.

- Fill in the needed details like date, amount, and category.

- Include any necessary documents, like receipts and invoices.

- Double-check the submission for accuracy before sending it in.

A detailed user guide can make these steps even easier. It helps all employees in the expense submission process.

How to Review and Approve Expenses

Managers can easily review expenses through QuickBooks Online’s dashboard. The approval process checks each submission against company policies. Key steps include:

- Go to the approvals section in the dashboard.

- Check each submission against policy guidelines by looking at attached documents.

- Talk to employees about any needed changes or extra info.

- Approve or reject submissions based on your findings.

Using QuickBooks Online for these tasks makes communication better. It also keeps all records organized and easy to find.

Reporting and Tracking Expenses in QuickBooks Online

Tracking expenses is key to good financial management. QuickBooks offers tools for deep expense analysis. Businesses can make reports to see expenses by category, department, or time.

This detailed look helps in making smart decisions and improving budget forecasts.

Utilizing QuickBooks Reports

QuickBooks has many reporting options for financial health monitoring. Users can spot spending trends, find errors, and check performance metrics. Its reports help track expenses well, making it easier to understand data and make decisions.

Tracking Approval Workflow Efficiency

It’s important to watch how fast expenses get approved. QuickBooks lets users see how long it takes for approval. This helps improve efficiency and keeps financial processes on track.

Best Practices for Expense Approvals

It’s important to have good practices for approving expenses. Clear rules help everyone know what’s okay and how to do it. This makes managing expenses easier for everyone.

Establishing Clear Guidelines

Clear expense rules help employees feel sure about the approval process. These rules should cover:

- What expenses need approval

- How to send in expenses

- When to send them in

- What happens if rules aren’t followed

Keeping these rules up-to-date and easy to find helps everyone stay on track.

Training Your Team

Training your team is key to better expense management. QuickBooks training can teach:

- How to use QuickBooks Online for expenses

- The risks of wrong submissions

- How to document and report expenses well

Training boosts knowledge and cuts down on mistakes. This makes the approval process smoother for everyone.

Common Challenges with Expense Approval Workflows

Organizations often face many challenges in their expense approval workflows. It’s key to know what these challenges are to solve them well. Issues like slow approvals, misunderstandings, and low employee engagement can really slow things down.

Identifying Potential Issues

Spotting specific problems in workflows is very important. These can be things like:

- Miscommunication about approval guidelines

- Slow response times from approvers

- Lack of employee training on submission procedures

- Inadequate tools for tracking expenses

Strategies for Overcoming Challenges

To tackle common expense management problems, there are a few ways to go:

- Make sure everyone knows the approval rules clearly.

- Use QuickBooks features to automate tasks and improve workflow.

- Provide more training to staff so everyone is on the same page.

- Get regular feedback from users to keep improving processes.

By using these strategies, you can beat the common challenges and make the expense approval process smoother.

| Challenge | Impact | Suggested Strategy |

|---|---|---|

| Miscommunication | Increased delays in approvals | Refine communication about guidelines |

| Slow Approvals | Frustration among employees | Automate tracking in QuickBooks |

| Lack of Training | Inconsistent submissions | Implement additional training sessions |

| Inadequate Tools | Challenges in tracking expenses | Upgrade to more efficient software features |

Integrating Other Financial Tools with QuickBooks Online

Integrating other financial tools with QuickBooks Online can boost a business’s efficiency. Finding the right tools that fit your company’s needs is key. Tools like expense tracking apps, budgeting software, and third-party apps can enhance QuickBooks.

Identify Tools for Integration

Looking to improve efficiency? Start by checking out the tools available. Some can make tasks quicker, saving you time. Here are some tools to consider:

- Expense Tracking Apps

- Budgeting Software

- Invoicing Tools

- Time Tracking Applications

Enhancing Your Workflow

Using these tools can make your workflow smoother and data more accurate. QuickBooks can automate tasks and connect financial apps easily. This makes managing finances better, leading to clearer reports and more accountability.

Security Considerations for Expense Approvals

It’s vital to have strong security when managing expense approvals in QuickBooks Online. Keeping financial data safe is key to avoid breaches and unauthorized access. Good data security practices help keep financial operations safe.

Protecting Sensitive Financial Data

Companies need to follow strict financial data protection steps to keep their financial info safe. Important actions include:

- Encrypting data when it’s sent.

- Choosing strong passwords that meet standards.

- Keeping security settings up to date to fix vulnerabilities.

Implementing Access Controls

Setting up access control policies makes sure only the right people see sensitive financial info. This reduces risks from unauthorized access. Important things to think about are:

- Changing user permissions based on roles in the company.

- Checking access rights often to match employee duties.

- Having a way to track changes in access permissions.

Conclusion

Setting up an expense approval workflow in QuickBooks Online is a smart move for any business. It makes managing money better and keeps everyone on the same page. This way, everyone knows who is spending what.

QuickBooks Online has all the tools you need to make this work smoothly. With these tools, businesses can track and approve expenses more easily. This helps teams keep a close eye on spending, leading to better financial choices.

In short, a good expense approval workflow is key for any business looking to get its finances in order. By following best practices and using QuickBooks Online to its fullest, companies can run their finances efficiently and securely.

FAQ

What is an expense approval workflow in QuickBooks Online?

An expense approval workflow in QuickBooks Online is a way to manage expense requests. It lets organizations review and approve or reject expenses before they are recorded. This process helps keep finances in check and ensures everything is done right.

How does an expense approval workflow benefit an organization?

It helps control spending and follow rules. It also cuts down on fraud and keeps a record of all expenses. This makes sure money is spent as planned.

What are the initial configuration steps for setting up QuickBooks Online for expense approvals?

First, turn on expense tracking features. Then, decide who can access what. Finally, set up categories for managing expenses well in QuickBooks Online.

How do I create expense categories in QuickBooks Online?

Create categories based on departments or projects. This helps track and manage budgets better. It also gives a clear view of where money is going.

What are approval limits and how do they function in QuickBooks Online?

Approval limits are the max amount an employee can ask for without needing more checks. They help control spending and make the approval process smoother in QuickBooks Online.

How can I submit and approve expenses using QuickBooks Online?

QuickBooks Online makes it easy to submit and approve expenses. Employees can easily send in their requests. Managers can then quickly check and approve them through the dashboard.

What features can I find in QuickBooks reporting for expense management?

QuickBooks reporting tools help analyze expenses by category, department, or time. This is key for making smart financial choices and keeping budgets in check.

What are the best practices for managing expense approvals in QuickBooks Online?

Make sure everyone knows the rules for submitting and approving expenses. Also, hold regular training on QuickBooks. This boosts compliance and makes the process more efficient.

What are some common challenges faced with expense approval workflows?

Issues include not understanding the rules, slow approvals, and low user interest. Finding and fixing these problems can make the workflow better.

How can integrating other financial tools with QuickBooks Online improve workflow?

Integrating tools like expense trackers or budgeting software can make things smoother. It automates tasks and ties everything together in QuickBooks Online.

What security considerations should be taken into account for expense approvals?

Keeping financial data safe is key. Use encryption, strong passwords, and control access. This ensures only the right people can handle financial info in QuickBooks Online.

- Tags: intuit quickbooks, intuit quickbooks login, intuit quickbooks online, quickbook, quickbooks, quickbooks accounting software, quickbooks customer service, quickbooks customer service number, quickbooks desktop, quickbooks desktop 2024, quickbooks log in, quickbooks login, quickbooks login online, quickbooks online, quickbooks online accountant, quickbooks online accounting, quickbooks online customer service, quickbooks online login, quickbooks online pricing, quickbooks payroll, quickbooks self employed, quickbooks software, quickbooks support phone number, quickbooks time, quickbooks time login, quickbooks workforce

Top Products

- QuickBooks Desktop Pro 2024 US Version

- QuickBooks Desktop Pro 2023 US Version

- QuickBooks Desktop Pro 2022 US Version

- QuickBooks Desktop Premier 2024 US Version

- QuickBooks Desktop Premier 2023 US Version

- QuickBooks Desktop Premier 2022 US Version

- QuickBooks Desktop Accountant 2024 US Version

- QuickBooks Desktop Accountant 2023 US Version

- QuickBooks Desktop Enterprise 2024 US Version

- QuickBooks Desktop Enterprise 2023 US Version

- QuickBooks for Mac 2024

- QuickBooks for Mac 2023

Popular Posts

How to categorize property tax payable in quickbooks online

Knowing how to categorize property tax payable in QuickBooks Online is key for keeping your financial records right. Property tax payable is the amount your business owes in property taxes. It can greatly affect your financial health. By learning to categorize property tax well, businesses can make sure their financial statements show their true obligations.

This knowledge is crucial as we dive into the steps and best practices for handling property tax payable in QuickBooks Online.

How much is quickbooks per month

Many users want to know the QuickBooks pricing for monthly costs. QuickBooks has various plans for different business needs. This lets users pick the right plan for their financial management.

What affects the QuickBooks monthly cost includes the QuickBooks edition, payment frequency, and extra features. This guide will explain the details of these plans. It will help you understand the costs of using QuickBooks for your business.

How does quickbooks work

QuickBooks is a key accounting software made by Intuit. It helps businesses manage their finances well. It works on a cloud-based platform, so users can access their financial data from anywhere.

This software makes tasks like bookkeeping, invoicing, and financial reporting easier. In this article, we’ll look at QuickBooks’ main features, its users, benefits, and challenges. We aim to help you understand how it can improve your financial management.

How do you record insurance payment in quickbooks

Recording insurance payments in QuickBooks is key for good insurance accounting. It helps business owners manage their money well and keep their books right. This is vital for the health of any business.

In this guide, we’ll show you how to record insurance payments easily. We’ll use QuickBooks guides and tips from accounting experts. This way, you can keep your financial records up to date.

How do you clock in hours in quickbooks desktop

In today’s fast-paced world, tracking time well is key for good payroll management. This article will show you how to clock in hours in QuickBooks Desktop. It’s a top accounting software that makes managing tasks easier. By learning how to track time, businesses can work better and pay employees right.

How are refunds categorized in quickbooks online

Knowing how to categorize refunds in QuickBooks Online is key for good financial management. It’s important to record refunds correctly to keep your finances clear. Businesses of all sizes can benefit from knowing how to do this right.

This knowledge helps make your financial records clear and accurate. It’s a basic step that can make a big difference.

Does quoteiq accept quickbooks online payments

Payment solutions are key in today’s business world. Many are looking into how platforms like QuoteIQ can improve their invoicing. A big question is: does QuoteIQ accept QuickBooks Online Payments? This article explores how QuoteIQ and QuickBooks Online Payments work together.

This shows how important it is to have good payment integration. It helps with cash flow and makes operations smoother. We’ll look at the benefits of using QuoteIQ with QuickBooks Online Payments. Plus, we’ll show you how to set it up.

Can you delete history under audit log quickbooks online

It’s important to know if you can delete entries from the audit log in QuickBooks Online. This is key for businesses that focus on financial accuracy and follow the rules. The audit log QuickBooks Online keeps a detailed history of changes to financial data. This ensures that all account activities are recorded clearly.

By tracking these changes, the audit log is crucial for good financial management. We will look into why the audit log matters and what happens if you try to delete its records. We’ll see how these actions impact your QuickBooks history.

Can quickbooks recievepayment by statements rather that individual invoices

In today’s fast-paced world, businesses need quick and easy ways to handle payments. Many QuickBooks users wonder if they can pay by statements instead of invoices. This method makes accounting simpler for companies.

Using payment statements has big advantages over traditional invoices. QuickBooks helps businesses manage payments better. This article will show you how payment statements work in QuickBooks and how they can help your business.

Can quickbooks online payments work with simple start

For small business owners, the question of whether QuickBooks Online Payments and QuickBooks Simple Start can work together is key. This integration is vital for managing finances effectively. It helps users handle transactions smoothly while using a basic accounting tool for solo businesses.

QuickBooks Online Payments lets users take payments online, making cash flow management easier. In this article, we explore how these two tools can boost efficiency for small businesses.