How to undo reconciliation in quickbooks online

Table of Contents

Keeping accurate financial records is key for businesses. QuickBooks Online helps a lot with this. Learning how to undo reconciliation in QuickBooks Online is important. It helps fix mistakes and makes sure your financial reports are real.

This article will show you how to do this. We’ll talk about why QuickBooks reconciliation is important. And how to fix common problems.

Key Takeaways

- Accurate reconciliation is vital for dependable financial records.

- Undoing reconciliation helps rectify errors in QuickBooks Online.

- Identifying reasons for reconciliation issues can prevent future mistakes.

- A systematic approach can simplify the reconciliation process.

- Utilizing QuickBooks features improves overall financial management.

Understanding Reconciliation in QuickBooks Online

Reconciliation in QuickBooks Online is key for keeping finances accurate. It matches the transactions in QuickBooks with bank statements. This helps find any differences between the two.

Knowing what reconciliation means helps improve financial management. It’s a way to spot areas for better financial handling.

What is Reconciliation?

Reconciliation is checking if two records match. For QuickBooks, it’s comparing bank transactions with QuickBooks entries. This step is crucial for keeping financial statements reliable.

Any differences found need to be looked into. This ensures there are no errors or issues.

Importance of Accurate Reconciliation

Reconciliation is very important. It helps prevent fraud and fixes accounting mistakes. With correct financial data, companies can plan better.

Regular reconciliations build trust in financial accuracy. This trust is key for making smart decisions and planning ahead.

Reasons You May Need to Undo a Reconciliation

QuickBooks helps manage financial records. Sometimes, users need to undo a reconciliation. Knowing why helps avoid reconciliation mistakes and improves financial reports.

Identifying Common Errors

There are several common errors that might make you undo a reconciliation. These include:

- Misclassifying transactions that affect fund allocations.

- Entering incorrect amounts that distort financial reports.

- Omitting transactions that should have been reconciled.

Spotting these errors is key to keeping records accurate. It prevents financial misunderstandings. Regular checks help keep QuickBooks secure and your finances in order.

Fraudulent Transactions

Finding fraudulent transactions means you must act fast. Undoing reconciliations fixes financial records quickly. It’s important to watch accounts closely to catch unauthorized activity early.

Step-by-Step Guide to Undo Reconciliation

Undoing reconciliation in QuickBooks Online might seem hard, but it’s easier with a clear plan. By following the right steps, you can easily manage your financial reports. This ensures your data is accurate and up-to-date.

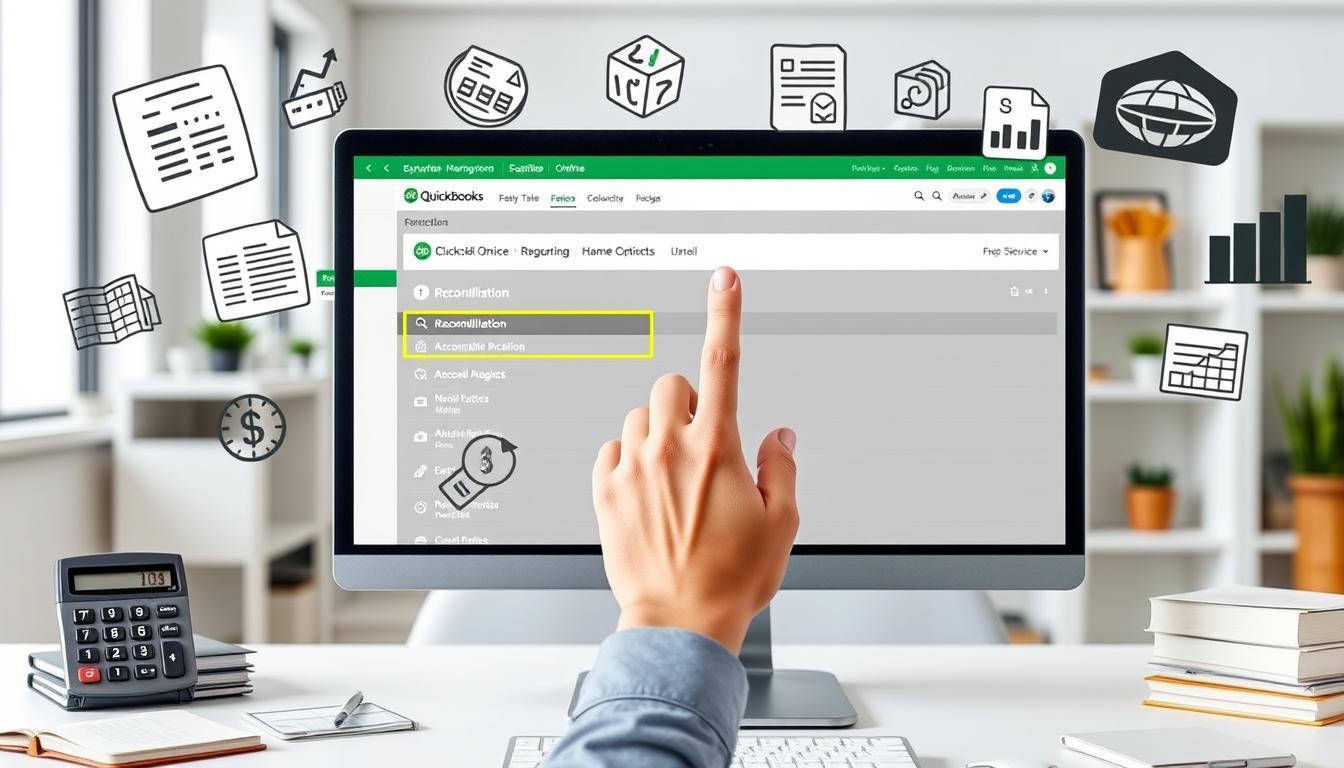

Accessing Your Reconciliation Reports

To start, you need to access reconciliation reports. Go to the “Reports” section in QuickBooks and choose “Reconciliation Reports.” Pick the report for the time period you need. This step is key for getting the right data and making accurate changes.

Finding the Right Period to Undo

Finding the right undo reconciliation period is important. QuickBooks Online lets you select period for reconciliation easily. This helps you focus on the transactions that need fixing, making the undo process smoother.

Steps to Undo a Reconciliation

To undo a reconciliation, follow a few simple steps. First, open the reconciliation report and find the “Undo” option. Then, confirm the transactions you want to adjust and make the necessary changes. This method makes it easier to understand and manage the reconciliation process.

| Step | Action | Details |

|---|---|---|

| 1 | Access Reports | Navigate to “Reports” and select “Reconciliation Reports.” |

| 2 | Select Period | Choose the relevant period for reconciliation review. |

| 3 | Undo Option | Open the report and click on the “Undo” option. |

| 4 | Confirm Transactions | Review and confirm the selected transactions for adjustments. |

Using QuickBooks Online to Manage Your Finances

Managing your finances well is key for any business. QuickBooks Online offers tools to help with this. It has features for tracking finances and boosting productivity. Using these QuickBooks features makes managing your money easy and efficient.

Leveraging Features for Better Financial Tracking

QuickBooks Online has strong features for better financial tracking. These include:

- Automatic updates for transactions, keeping your records up-to-date.

- Customizable dashboards that show important financial info clearly.

- Deep reporting tools that give insights into your finances.

These tools help businesses check their financial health. They make daily tasks smoother and improve cash flow management.

Integrations with Other Financial Tools

QuickBooks Online also offers QuickBooks integrations with other financial tools. These integrations help businesses:

- Make accounting more efficient with payment processors that make transactions easier.

- Use budgeting software to keep a close eye on expenses and income.

- Manage data better for accurate reports and decisions.

These integrations give a full view of finances. They help users understand their money situation fully.

How to Avoid Future Reconciliation Issues

Keeping accurate financial records is key for any business. A structured approach helps avoid errors in the reconciliation process. Regular reviews catch financial issues early, allowing for quick fixes.

This practice boosts financial oversight. It shows the value of precise records.

Developing a Regular Review Process

Creating a regular review process means setting up a schedule for financial checks. It’s important to:

- Set weekly or monthly review times

- Assign team members for reconciliation

- Document any issues with clear solutions

This ensures QuickBooks is used efficiently. It helps catch errors early, saving time later.

Utilizing QuickBooks Best Practices

To get the most from QuickBooks, follow accounting best practices. Training team members on QuickBooks features improves data accuracy. Timely reconciliations reduce errors and improve financial trust.

- Enter data consistently and accurately

- Keep software up to date

- Use QuickBooks tools to automate tasks

Following these tips helps keep financial operations smooth. It also builds a culture of openness. By focusing on regular reviews and QuickBooks best practices, businesses protect their finances.

Common Mistakes to Avoid When Undoing Reconciliation

Undoing a reconciliation in QuickBooks can be tricky. It’s important to know the common mistakes to avoid. This helps keep your financial records accurate and your data safe.

Misinterpreting Transaction Dates

One big mistake is misinterpreting transaction dates. Getting these dates right is key for good reconciliation. If you get them wrong, it can mess up your financial statements.

Always double-check each date before making any changes. This way, you can avoid reconciliation mistakes. It also makes sure your financial records are correct.

Failing to Backup Data Before Changes

Another mistake is not backing up data before you start reconciliations. The importance of data backup is huge. It keeps your data safe from loss.

QuickBooks Online offers ways to keep your data safe. This is important for QuickBooks data safety. It lets you get back to your original records if needed.

Impact of Incorrect Reconciliation on Your Financial Records

When reconciliation is wrong, it messes up your financial records a lot. This can make your profit and loss statements look very different from reality. It makes it hard to make good decisions and plan your finances. Fixing these problems early helps keep your financial reports accurate.

How It Affects Profit and Loss Statements

Wrong reconciliation can mess up your profit and loss statements. This can really affect your budgeting and planning. Some of the problems include:

- Incorrect profit margins: If you get your revenues or expenses wrong, it can mess up how you see your financial health.

- Impaired strategic planning: Making decisions with bad data can lead to mistakes.

- Investor relations: If your financial reports are off, it can hurt your relationship with investors and make it harder to get funding.

Consequences for Tax Filing

Getting your reconciliation wrong can also mess up your taxes. It can lead to:

- Overpayments or underreporting: If your records are off, you might end up paying too much or too little in taxes.

- Increased audit risk: If your records look suspicious, the IRS might want to take a closer look.

- Complicated tax preparation: Bad financial reports can make it harder to file your taxes on time.

By focusing on accurate reconciliation, you can improve your financial health and meet your tax obligations better.

| Impact of Incorrect Reconciliation | Potential Consequences |

|---|---|

| Distorted profit and loss statements | Misleading financial performance data |

| Financial impact on decisions | Poor budgeting and planning |

| Tax filing consequences | Increased risk of audits |

| Incorrect financial reporting | Loss of investor confidence |

Resources for Learning More About QuickBooks Online

There are many resources for those wanting to improve their QuickBooks Online skills. These tools help with financial management and offer great learning chances. QuickBooks Online tutorials are a great way to learn its features and how to use them.

Online Tutorials and Guides

Intuit’s official QuickBooks site has lots of tutorials, including videos and step-by-step guides. These resources are for all skill levels, making them perfect for anyone wanting to learn QuickBooks. They cover important topics like:

- Navigating the dashboard

- Creating invoices

- Running financial reports

Community Support and Forums

QuickBooks community support and forums are great for solving common problems. The forums are places where users share their experiences and get advice from others. This shared knowledge helps users overcome challenges more easily.

Alternative Solutions for Reconciliation Challenges

Businesses facing reconciliation challenges can find relief in alternative solutions. Third-party applications offer robust features for better financial management. These tools make reconciliation easier and ensure accurate financial records.

Third-Party Applications

Integrating third-party apps with QuickBooks gives access to advanced financial tools. These apps help with:

- Automated transaction imports

- Real-time expense tracking

- Simplified invoice management

- Efficient reconciliation processes

These tools use QuickBooks integrations to improve data accuracy. They are crucial for businesses aiming for efficient financial management.

Professional Accounting Services

When reconciliation issues don’t go away, professional accounting services are a good option. Expert accountants know a lot about financial management. They ensure compliance and offer custom financial advice. This partnership helps businesses:

- Handle complex reconciliation tasks

- Get advice on financial strategy

- Implement effective accounting solutions

Professional services boost financial health and let business owners focus on growth. They handle daily challenges, freeing up time for strategic planning.

Conclusion

Understanding how to undo reconciliations in QuickBooks Online is key for any business’s success. It keeps your financial records accurate. This helps in making better decisions and tracking profits and losses.

Use the tips from this article to make your reconciliation process smoother. Following best practices keeps your finances healthy and in line with the law. This makes it easier to see how your business is doing.

Work on preventing reconciliation problems and keeping your records accurate. Learning these skills helps you build a strong financial base. This supports your business goals.

FAQ

What does it mean to undo reconciliation in QuickBooks Online?

Undoing reconciliation in QuickBooks Online means fixing past mistakes in your financial records. It’s key to keeping your books right and financial reports accurate.

How do I identify errors that require me to undo reconciliation?

Look out for mistakes like wrong transaction types, amounts, or missing entries. Regular checks help spot these errors and keep your finances right.

What steps should I take to undo a reconciliation in QuickBooks Online?

First, go to the “Reports” section in QuickBooks Online. Pick the report for the period you want to fix. Then, click “Undo” and follow the instructions to adjust your records.

Can I prevent reconciliation issues in the future?

Yes, you can. Regular checks and following QuickBooks tips can help avoid problems. Keeping data entry consistent and reconciling on time is crucial.

How does incorrect reconciliation impact my financial records?

Wrong reconciliations can mess up your profit and loss statements. This can lead to bad decisions and trouble with taxes. So, it’s vital to get reconciliations right.

Where can I find resources to learn more about QuickBooks Online?

You can find lots of help online. Intuit’s QuickBooks site has tutorials and guides. There are also forums where you can ask and share with others.

Are there alternative solutions for managing reconciliation challenges?

Yes, there are. Third-party apps can offer better tools for managing money. Or, you could hire accounting pros to help with reconciliations and stay compliant.

- Tags: intuit quickbooks, intuit quickbooks login, intuit quickbooks online, quickbook, quickbooks, quickbooks accounting software, quickbooks customer service, quickbooks customer service number, quickbooks desktop, quickbooks desktop 2024, quickbooks log in, quickbooks login, quickbooks login online, quickbooks online, quickbooks online accountant, quickbooks online accounting, quickbooks online customer service, quickbooks online login, quickbooks online pricing, quickbooks payroll, quickbooks self employed, quickbooks software, quickbooks support phone number, quickbooks time, quickbooks time login, quickbooks workforce

Top Products

- QuickBooks Desktop Pro 2024 US Version

- QuickBooks Desktop Pro 2023 US Version

- QuickBooks Desktop Pro 2022 US Version

- QuickBooks Desktop Premier 2024 US Version

- QuickBooks Desktop Premier 2023 US Version

- QuickBooks Desktop Premier 2022 US Version

- QuickBooks Desktop Accountant 2024 US Version

- QuickBooks Desktop Accountant 2023 US Version

- QuickBooks Desktop Enterprise 2024 US Version

- QuickBooks Desktop Enterprise 2023 US Version

- QuickBooks for Mac 2024

- QuickBooks for Mac 2023

Popular Posts

How to categorize property tax payable in quickbooks online

Knowing how to categorize property tax payable in QuickBooks Online is key for keeping your financial records right. Property tax payable is the amount your business owes in property taxes. It can greatly affect your financial health. By learning to categorize property tax well, businesses can make sure their financial statements show their true obligations.

This knowledge is crucial as we dive into the steps and best practices for handling property tax payable in QuickBooks Online.

How much is quickbooks per month

Many users want to know the QuickBooks pricing for monthly costs. QuickBooks has various plans for different business needs. This lets users pick the right plan for their financial management.

What affects the QuickBooks monthly cost includes the QuickBooks edition, payment frequency, and extra features. This guide will explain the details of these plans. It will help you understand the costs of using QuickBooks for your business.

How does quickbooks work

QuickBooks is a key accounting software made by Intuit. It helps businesses manage their finances well. It works on a cloud-based platform, so users can access their financial data from anywhere.

This software makes tasks like bookkeeping, invoicing, and financial reporting easier. In this article, we’ll look at QuickBooks’ main features, its users, benefits, and challenges. We aim to help you understand how it can improve your financial management.

How do you record insurance payment in quickbooks

Recording insurance payments in QuickBooks is key for good insurance accounting. It helps business owners manage their money well and keep their books right. This is vital for the health of any business.

In this guide, we’ll show you how to record insurance payments easily. We’ll use QuickBooks guides and tips from accounting experts. This way, you can keep your financial records up to date.

How do you clock in hours in quickbooks desktop

In today’s fast-paced world, tracking time well is key for good payroll management. This article will show you how to clock in hours in QuickBooks Desktop. It’s a top accounting software that makes managing tasks easier. By learning how to track time, businesses can work better and pay employees right.

How are refunds categorized in quickbooks online

Knowing how to categorize refunds in QuickBooks Online is key for good financial management. It’s important to record refunds correctly to keep your finances clear. Businesses of all sizes can benefit from knowing how to do this right.

This knowledge helps make your financial records clear and accurate. It’s a basic step that can make a big difference.

Does quoteiq accept quickbooks online payments

Payment solutions are key in today’s business world. Many are looking into how platforms like QuoteIQ can improve their invoicing. A big question is: does QuoteIQ accept QuickBooks Online Payments? This article explores how QuoteIQ and QuickBooks Online Payments work together.

This shows how important it is to have good payment integration. It helps with cash flow and makes operations smoother. We’ll look at the benefits of using QuoteIQ with QuickBooks Online Payments. Plus, we’ll show you how to set it up.

Can you delete history under audit log quickbooks online

It’s important to know if you can delete entries from the audit log in QuickBooks Online. This is key for businesses that focus on financial accuracy and follow the rules. The audit log QuickBooks Online keeps a detailed history of changes to financial data. This ensures that all account activities are recorded clearly.

By tracking these changes, the audit log is crucial for good financial management. We will look into why the audit log matters and what happens if you try to delete its records. We’ll see how these actions impact your QuickBooks history.

Can quickbooks recievepayment by statements rather that individual invoices

In today’s fast-paced world, businesses need quick and easy ways to handle payments. Many QuickBooks users wonder if they can pay by statements instead of invoices. This method makes accounting simpler for companies.

Using payment statements has big advantages over traditional invoices. QuickBooks helps businesses manage payments better. This article will show you how payment statements work in QuickBooks and how they can help your business.

Can quickbooks online payments work with simple start

For small business owners, the question of whether QuickBooks Online Payments and QuickBooks Simple Start can work together is key. This integration is vital for managing finances effectively. It helps users handle transactions smoothly while using a basic accounting tool for solo businesses.

QuickBooks Online Payments lets users take payments online, making cash flow management easier. In this article, we explore how these two tools can boost efficiency for small businesses.